Automate and modernize your global financial operations with Dynamics 365 Finance. Monitor performance in real time, predict future outcomes, and make data-driven decisions to drive business growth.

Explore Dynamics 365 for Finance and Operations capabilities

Enhance your financial decision making

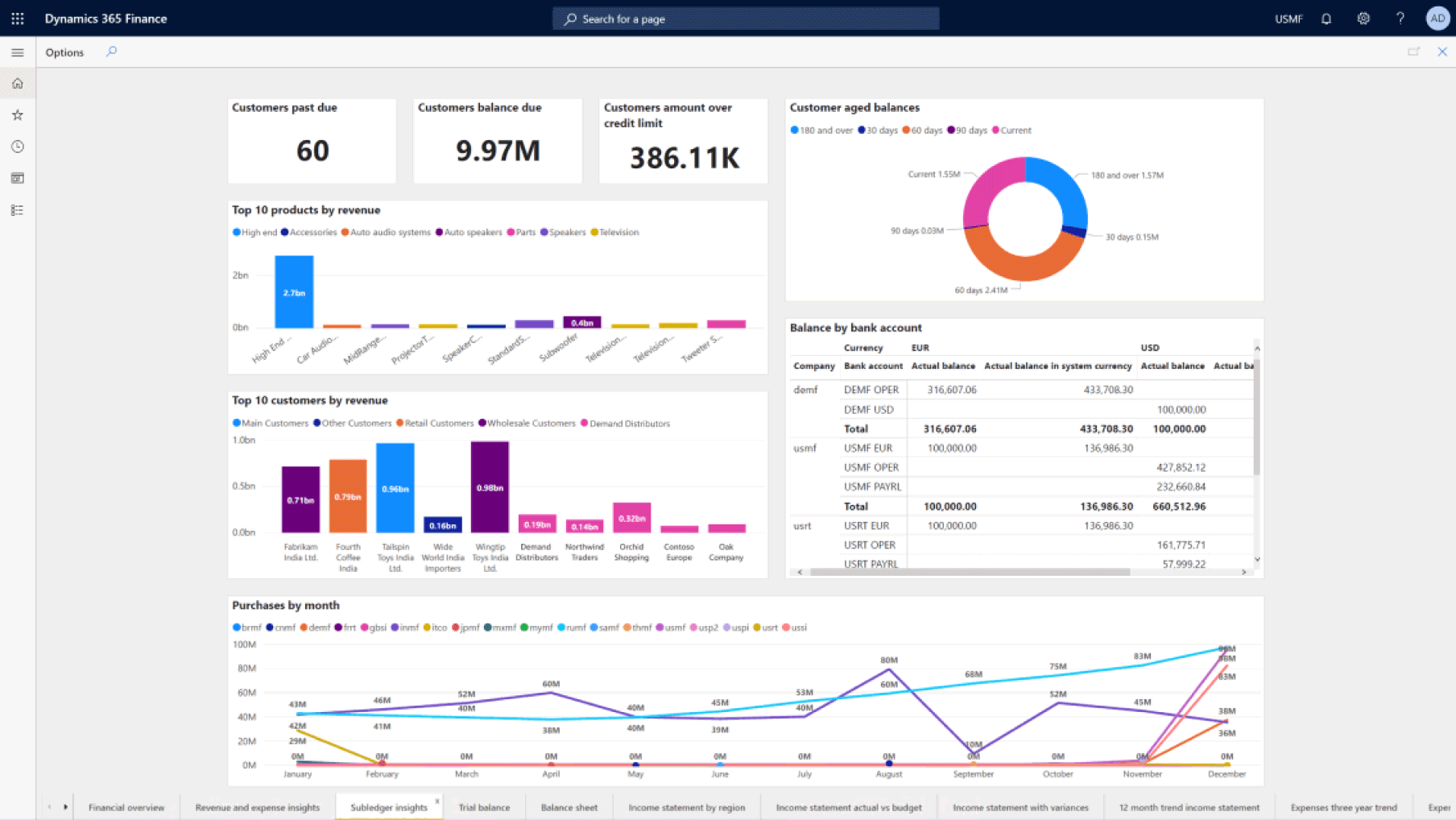

Reliably predict customer payments. Proactively reduce write-offs and improve your margin by understanding if and when customers will pay their invoices.

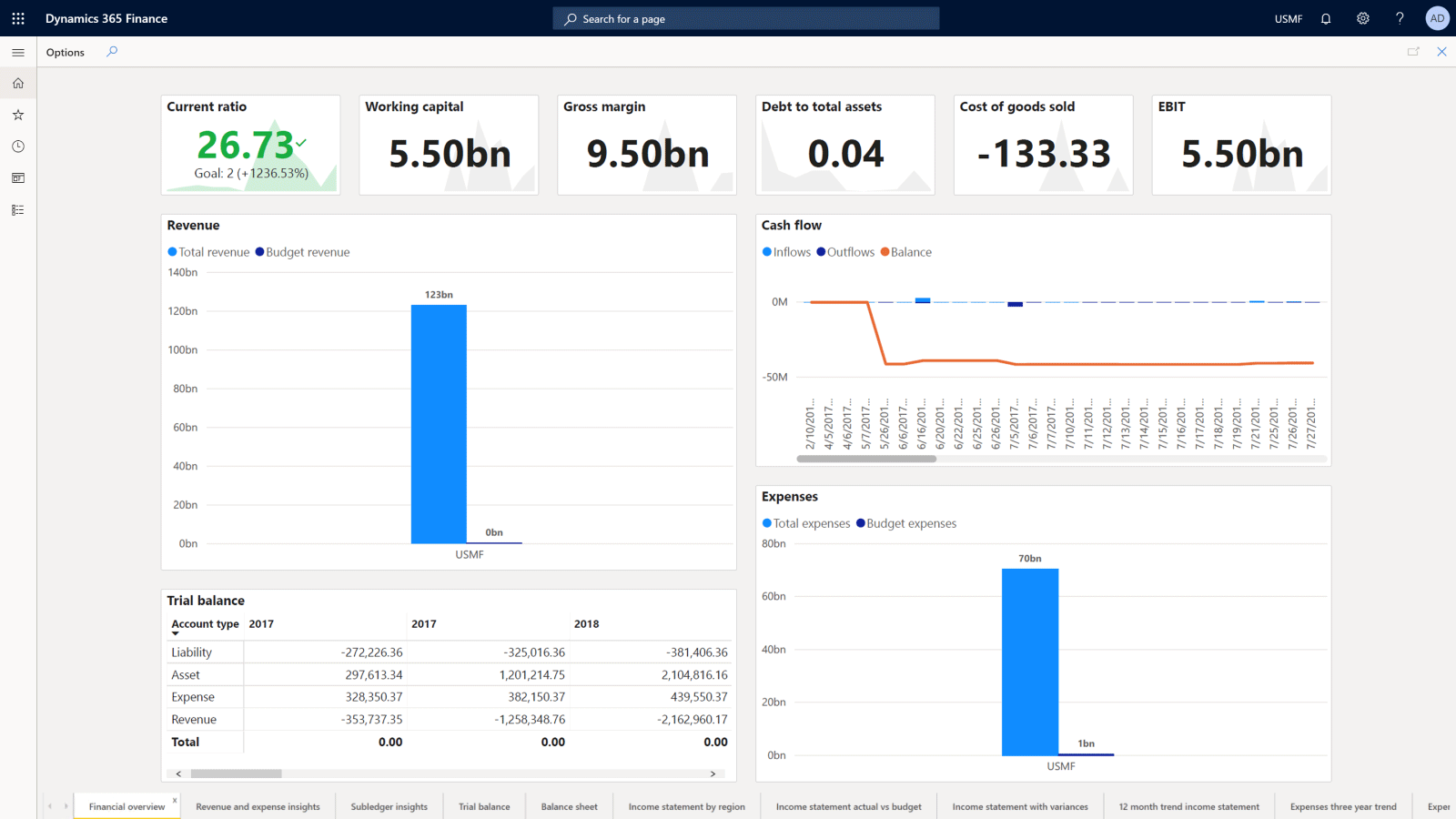

Accurately project your cash flow. Monitor cash flow in real time, identify trends, and make data-driven decisions using an intelligent and customizable cash flow–forecasting solution.

Adapt quickly with intelligent budget proposals. Reduce the time and effort spent on budgeting by letting the system perform the tasks for you. Quickly consolidate and analyze years of historical data to create your budget forecast.

Unify and automate your financial processes

Get more done with role-based workspaces, Office 365 integration, and predictive insights that let you automate and prioritize fiscal tasks.

Customize documents such as invoices and statements to easily adapt to changing business requirements with Office 365 templates.

Thrive in a subscription-based economy with automated recurring billing to easily adapt to new revenue recognition standards, reduce audit costs, and accurately calculate and report your financial statements.

Have a strategic impact and reduce costs

Decrease global financial complexity and risk

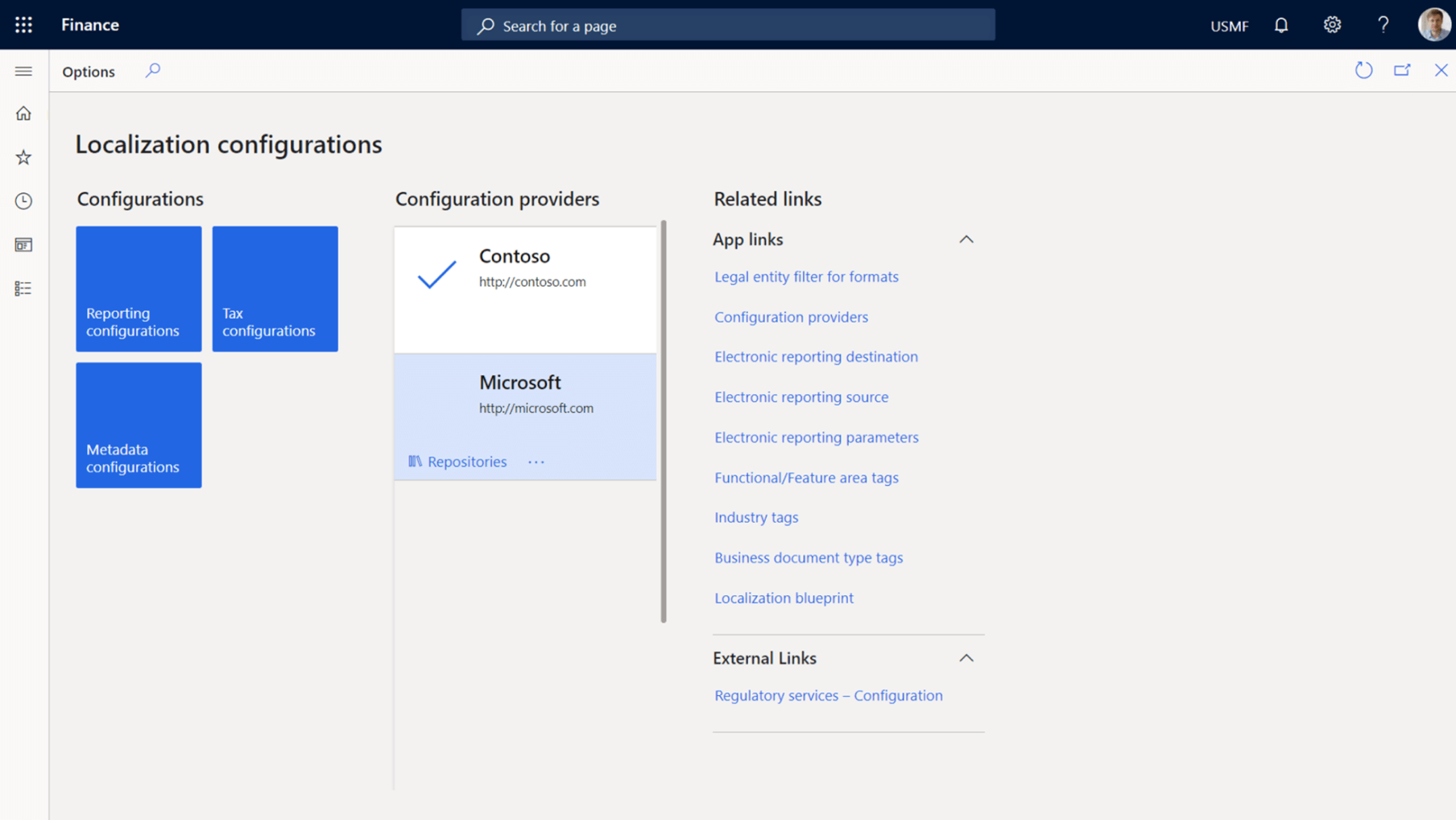

Easily adjust to changing global financial requirements using a flexible, guided, rules-based chart of accounts and dimensions. Manage frequently changing regulatory requirements with no-code configurable tax, e-invoicing, payment, and reporting formats.

Meet local and global business requirements, improve governance, reduce risks, and ensure compliance across 37 countries and 42 languages out-of-the-box. Further extend Finance with prebuilt partner solutions to meet your local needs.

Optimize your financial operations

Move beyond transactional financial management to proactive operations that enhance decision making, protect revenue, mitigate risks, and reduce costs.

- Intuitive role-based workspaces

- Intelligent budgeting and forecasting

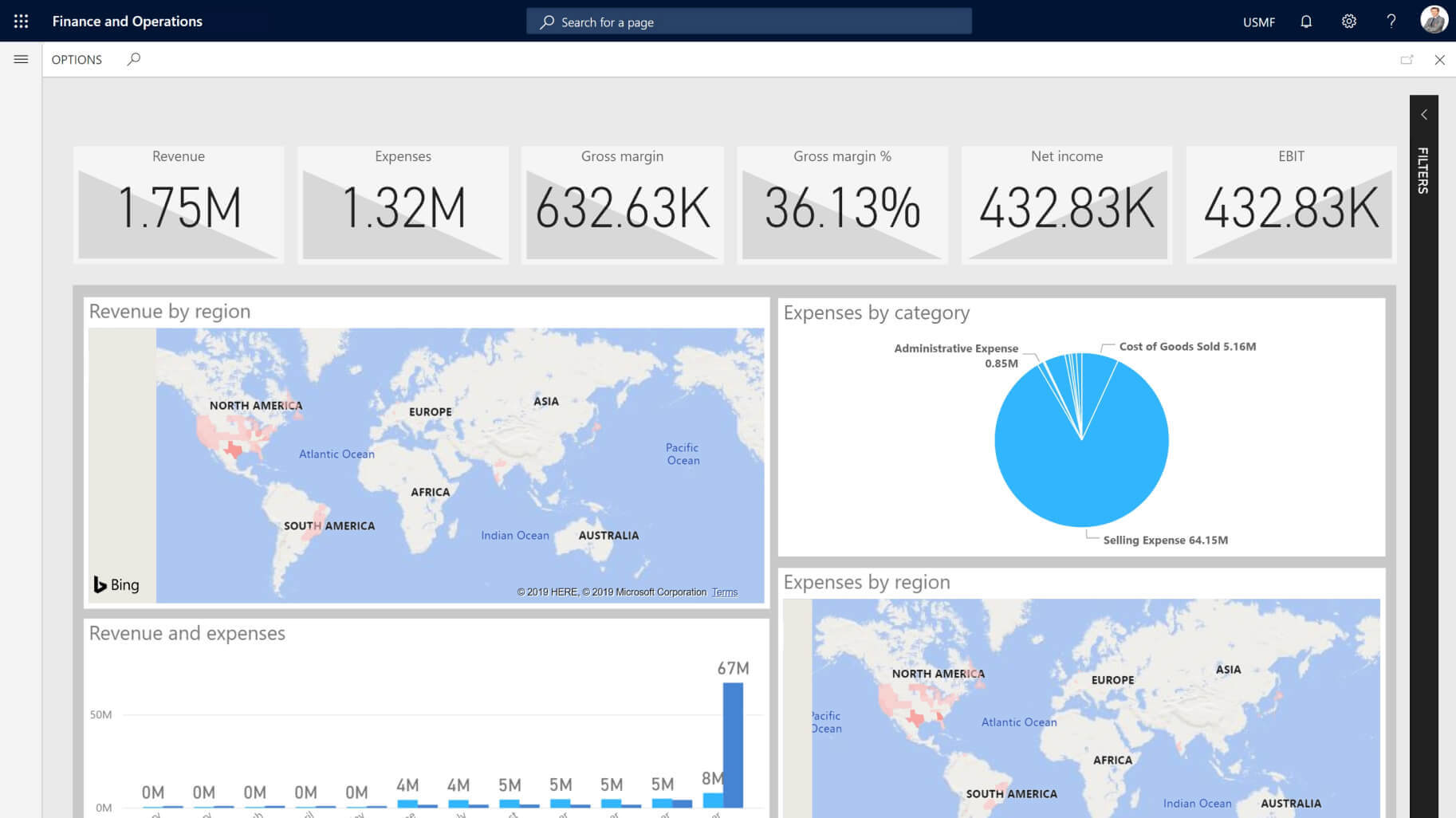

- Holistic financial reporting and analytics

- Automated credit and collections

- Streamlined revenue recognition

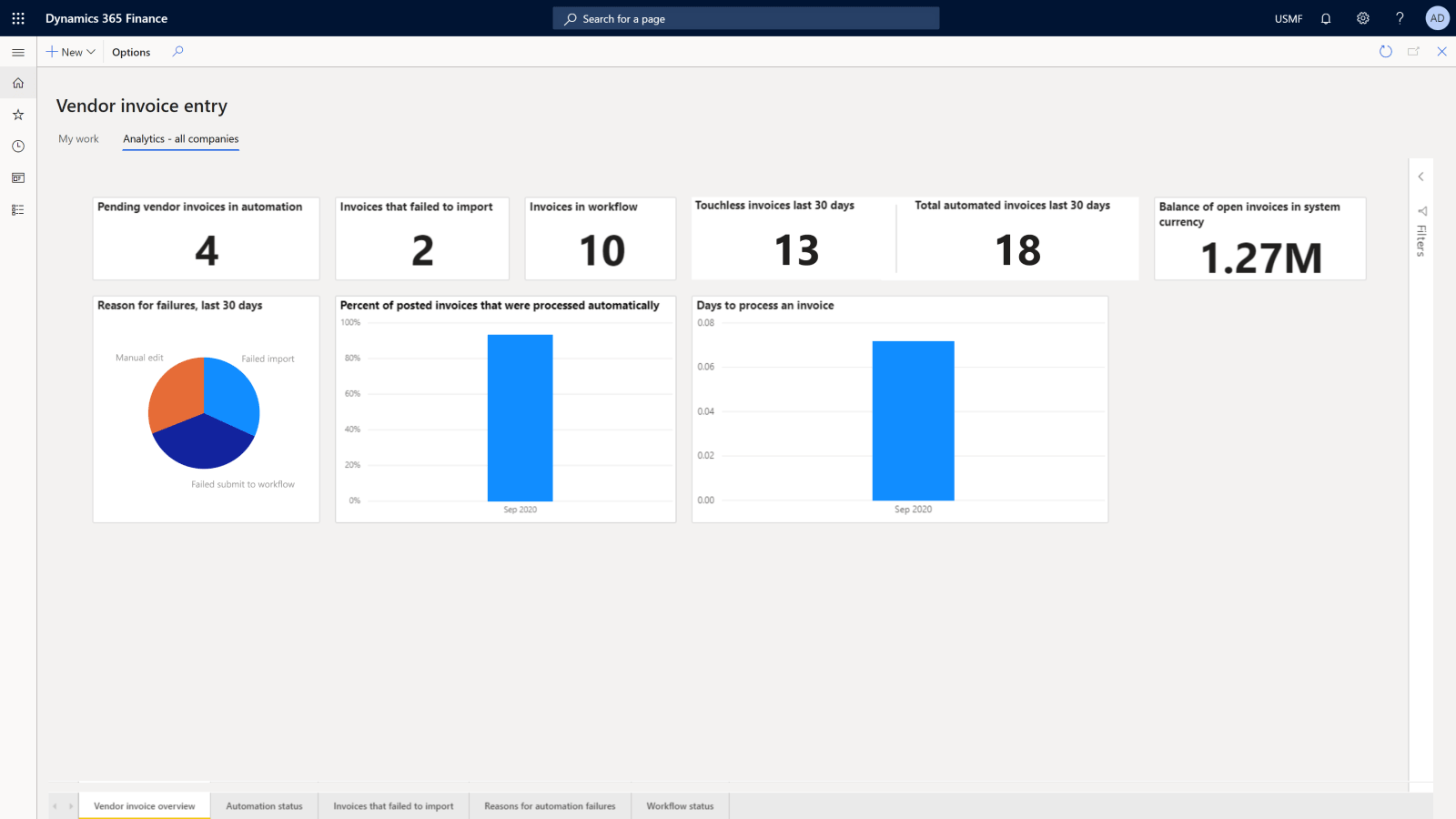

- Touchless vendor invoicing

- Expansive localizations

- Cost-effective compliance

- Extensive regulatory services